Consumer confidence ticks up

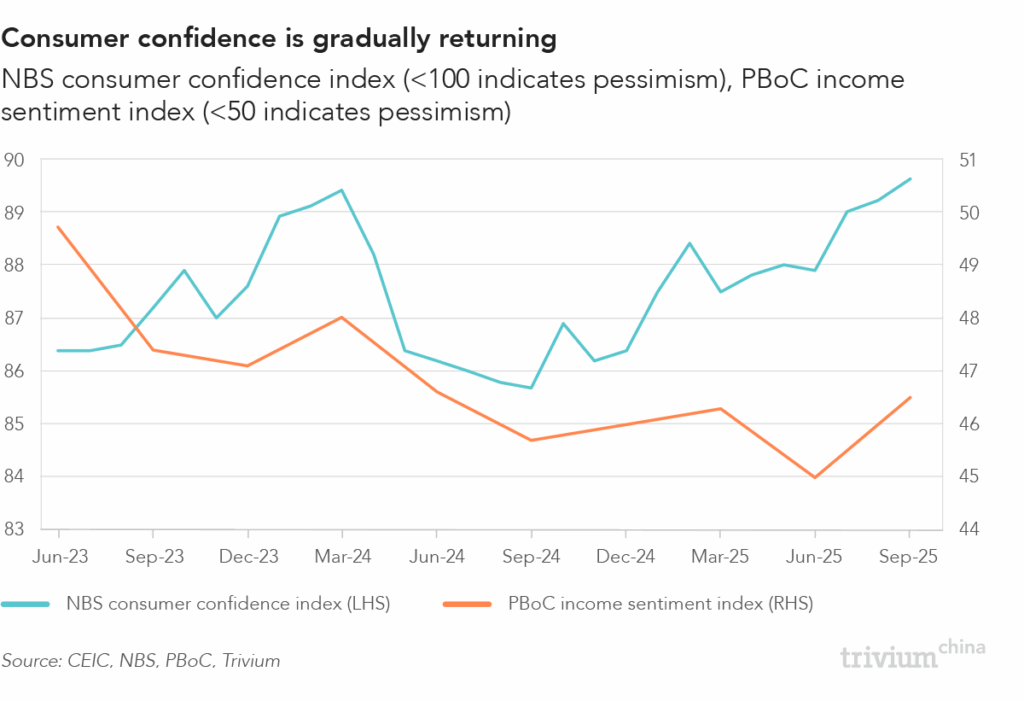

Consumers are still feeling pessimistic – but the tide is turning.

Consumer confidence surveys published in recent weeks by the central bank (PBoC) and stats bureau (NBS) show sentiment improving after years of gloom.

Some context: Every quarter, the PBoC surveys households to gauge sentiment on current and future economic conditions – with an index above 50 indicating optimism and below 50 indicating pessimism.

- Meanwhile, the NBS conducts a monthly household survey to gauge consumer confidence levels, with a score above 100 indicating confidence, and below 100 indicating pessimism.

The big takeaway: Consumer confidence remains weak but has improved significantly from previous quarters.

- The PBoC income confidence index ticked up to 45.9 in Q3, the highest score in six quarters.

- The employment expectations index came in at 42.1, up 40 basis points from the previous quarter.

- Meanwhile, the NBS consumer confidence index edged up to 89.6 in September, the highest score in almost 3 years.

You ask: Why hasn’t this improvement shown up in retail sales of consumer goods, which are growing at their slowest rate in over a year?

We answer: Consumer confidence is lifting service consumption, not goods spending.

- Service sales – which account for almost half of household spending – surged by 6.0% y/y in September, and are up 5.2% year-to-date.

Get smart: China’s consumption landscape is shifting away from goods and toward services.

- That shift helps explain why confidence is improving without a matching improvement in headline retail sales.

- It also suggests that services, not goods, will drive consumption growth in 2026.