Q1 GDP growth beats expectations, but weaknesses remain

Per data released by the stats bureau on Wednesday, Q1 GDP grew by 5.4% y/y, the same growth rate as the previous quarter.

Growth was driven by the usual suspects:

- Industrial output surged 6.3% y/y throughout Q1

- Fixed asset investment in manufacturing facilities grew an astonishing 9.1%

- Exports grew 5.8%

Promisingly, Caixin’s new economy index – which approximates the contribution of high-value-added industries to total GDP – averaged 33.8% in Q1, the highest value on record.

However, it wasn’t all sunshine and roses:

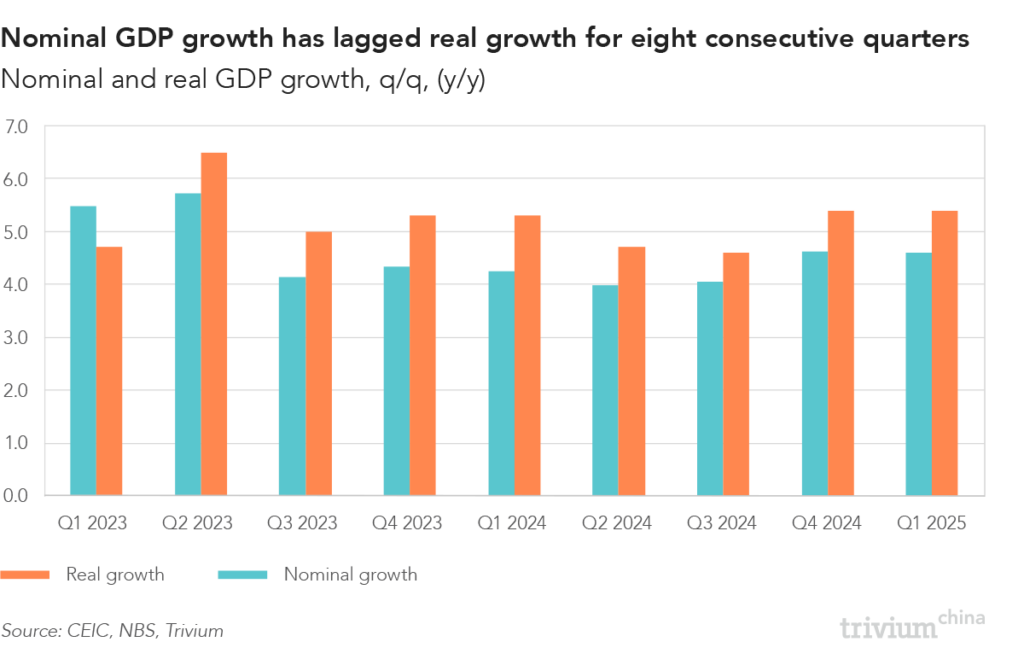

On a nominal basis – which incorporates price effects – GDP only grew by 4.6%.

- This is the eighth consecutive quarter nominal growth has lagged behind real growth – reflecting deeply embedded deflationary pressures.

Why it matters: Nominal growth better reflects how businesses and households experience economic conditions – profits, wages, and government tax revenue are strongly correlated with nominal growth.

Meanwhile, on a seasonally adjusted quarter-on-quarter basis, GDP expanded by 1.2%, a sharp drop from the 1.6% q/q growth in Q4 2024.

Household consumption also lagged overall GDP growth. Throughout Q1:

- Retail sales of consumer goods grew 4.6% y/y

- Retail sales of services grew 5% y/y

Get smart: China’s punchy GDP growth masks underlying economic weaknesses.

- In particular, an overreliance on industrial output and exports leaves the economy vulnerable to the trade war it now faces with the US.

- If Beijing wants to maintain economic momentum throughout Q2, it must do more to boost domestic consumption.