PBoC cuts MLF rate

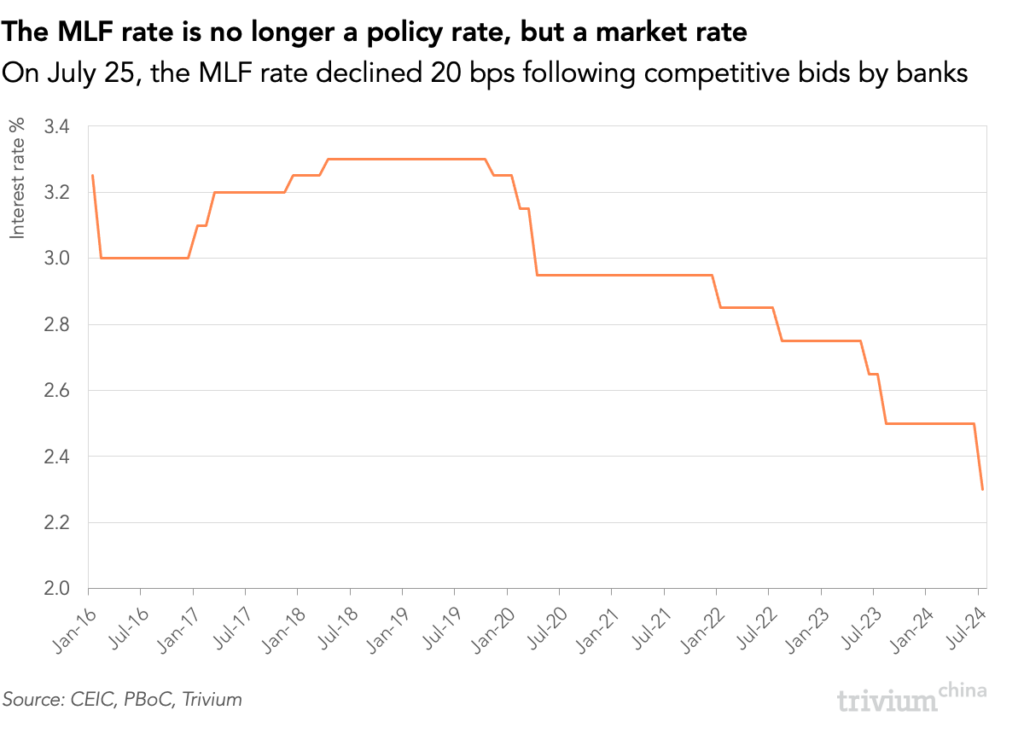

In a surprise move, China’s central bank (PBoC) cut the interest rate on its medium-term lending facility (MLF).

The details: On Thursday, the PBoC lent RMB 200 billion to banks via the MLF.

- No bonds matured.

It lent the funds at an interest rate of 2.3%, 20 bps below the previous level.

- The PBoC last cut the MLF rate in August 2023.

The move follows a spate of other cuts.

- On Tuesday, the PBoC cut its seven-day reverse repo rate and standing lending facility (SLF) rate by 10 bps.

- Meanwhile, the one-year and five-year loan prime rates (LPR) declined by 10 bps.

However, the MLF cut was a surprise because the PBoC already lent RMB 100 billion through the MLF on July 15.

- The PBoC usually only uses the MLF once a month.

- The last time it conducted MLF operations twice was November 2020.

The interest rate on Thursday’s MLF loans was determined by banks submitting competitive bids for the funds.

- Previously, the PBoC set the rate.

ICYDK: The MLF was a policy rate the PBoC used to guide medium- and long-term interest rates. But in June, the PBoC said it would regulate the economy using one short-term rate only.

Get smart: It’s now official – the MLF is no longer a policy rate but a market rate.

What we’re pondering: The MLF was ineffective as a policy rate.

- Will the PBoC continue using it to manage liquidity?