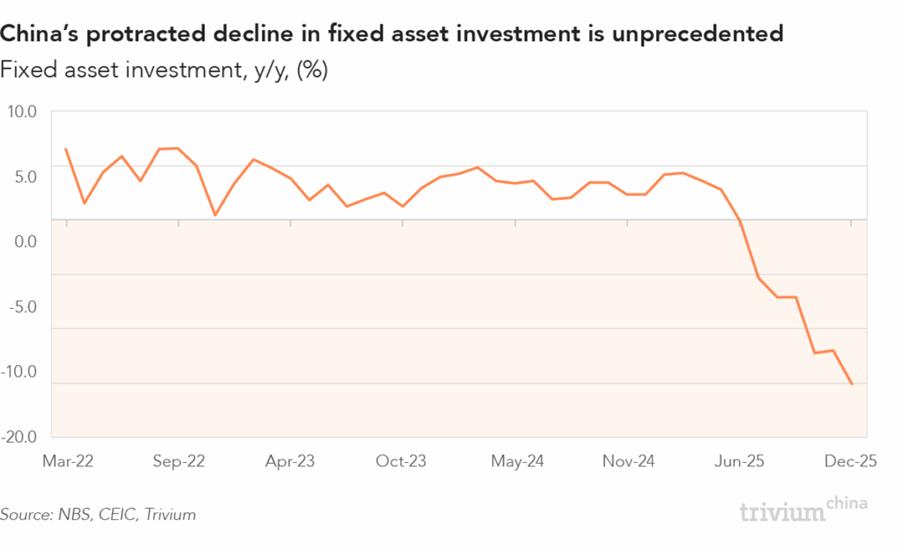

China set for permanently slower investment growth

Weak investment growth might be China’s new normal.

ICYDK: In December, fixed asset investment (FAI) fell 15.1% y/y, after declining 12.0% and 12.2% in November and October, respectively (check out our explanation for the decline).

Was this an anomaly?

- No.

FAI will continue to face numerous headwinds in the coming years, including:

- A further decline in property investment

- Beijing’s anti-involution drive weighing on manufacturing investment

- Renewable energy capacity expansion slowing as the sector hits structural impediments to further build-out

- Local governments’ financial weakness limiting infrastructure investment

Beijing’s efforts to turn things around have so far fallen short.

- In October, policy banks injected RMB 500 billion into new infrastructure projects, and local governments were cleared to issue an extra RMB 200 billion in bonds to fund public works – but FAI failed to rebound.

- In mid-January, the central bank (PBoC) and finance ministry (MoF) rolled out measures to reduce borrowing costs for private sector firms – this might boost investment marginally, but won’t counter the broader slowdown.

So where will investment growth come from in 2026?

- We’re expecting an increase in infrastructure funding from MoF special treasury bonds and PBoC lending to policy banks when the legislature meets in March.

- Meanwhile, State Grid has announced it will embark on a massive investment spree over the next five years.

Our take: Beijing can’t afford to let FAI continually drag on growth like it did in Q4, meaning policymakers will pull out the stops to get FAI growth back in the black asap.

- But given the headwinds, FAI’s contribution to 2026 GDP growth is looking marginal at best.