Margin trading surges as stocks rally

Margin trading is surging as China’s stock markets make an unexpected recovery.

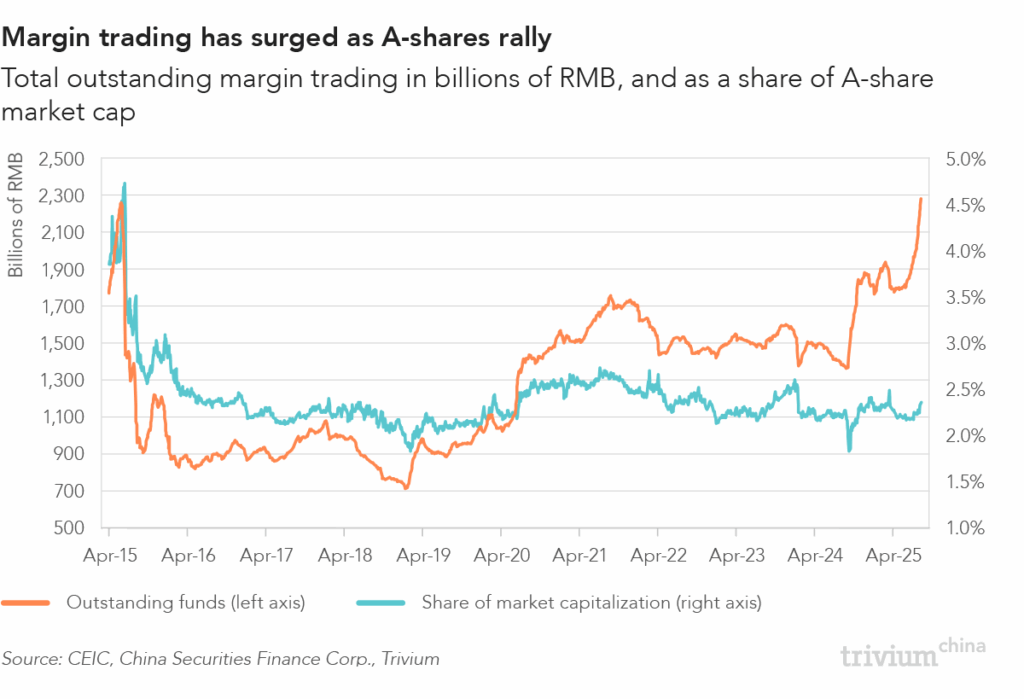

According to China Securities Finance Corp., the outstanding balance of stocks purchased with debt – known as margin trading – reached a record RMB 2.28 trillion on September 1, surpassing the previous high of RMB 2.27 trillion in mid-2015.

ICYDK: China’s stock markets have been on a tear since late-June.

- On Wednesday, the CSI 300 Index – which tracks the biggest stocks listed in Shanghai and Shenzhen – was up 15.6% from mid-June levels.

- On Monday, the index hit its highest level since March 2022.

Despite the value increase in margin trading, there is no indication the practice is exacerbating financial risks.

- Current levels of margin trading account for only 2.4% of market capitalization, well the below values a decade earlier.

- Meanwhile, the average margin ratio – the amount of equity investors hold as collateral against the debt – is ~290%, well above the 140% level which securities brokerages regard as risky (21st Century Biz).

Get smart: China’s economic fundamentals don’t support a stock market rally.

- Factory gate deflation is entrenched, consumer confidence remains weak, and property prices continue to fall.

- Yet with interest rates so low, the risk is that households will plough their savings into a rising stock market, inflating a bubble.

Get smarter: Beijing desperately needs share valuations to rise to help fund innovative firms, ease pressure on the pension system, and support consumption (listen to our podcast, China’s surging stock market for more).

The upshot: Beijing wants stocks to rise – but not too fast.

- Threading that needle will be the challenge of coming months.