Auto and catering sales dragged on consumption in July

Cars and restaurants are mainly to blame for July’s consumption slowdown.

Per data released by the stats bureau (NBS):

- Retail sales of consumer goods grew 3.7% y/y in July, the slowest rate of expansion since December 2024

- Retail sales of services grew 4.6% y/y, the slowest growth rate in 14 months

Consumer goods growth was dragged down by contracting auto sales, which account for roughly ~11% of retail sales.

- Auto sales declined 1.5% y/y in July, marking the first decline in five months.

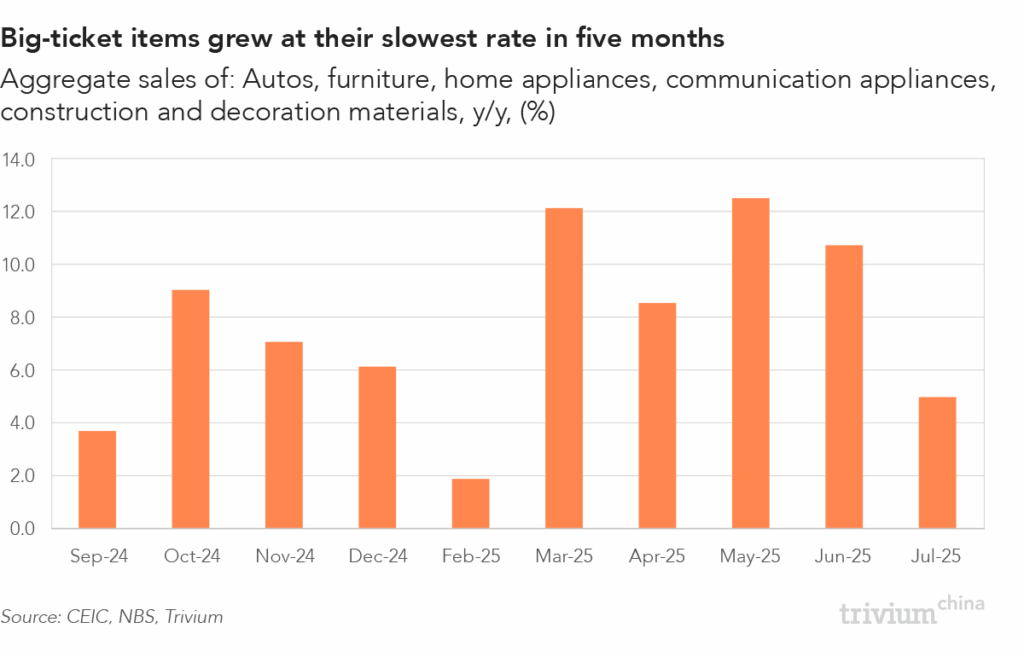

Meanwhile, other big-ticket sales grew strongly, supported by the government’s trade-in program.

- Home appliances sales grew 28.7% y/y.

- Furniture sales grew 20.6%.

- Mobile phone sales phones expanded 14.9%.

However, driven by the outsized impact of auto sales, aggregate growth of big-ticket items slowed to 5% y/y – the slowest rate in five months.

On a seasonally adjusted month-on-month basis, retail sales shrank 0.1%, marking the second consecutive m/m contraction.

Meanwhile, sluggish catering sales were the main factor dragging on service sales growth.

- Catering sales only edged up 1.1% y/y, largely a result of the Party’s overzealous clampdown on official banquets and dining.

Our take: This consumption slowdown is concerning, but we don’t expect policymakers to panic. Beijing will only push out a consumption stimulus once it can confidently answer “no” to at least two of the following questions:

- Is China’s surging export growth sustainable and sufficient to substitute for lagging domestic consumption?

- Can the consumer goods trade-in program continue juicing the sale of big-ticket items?

- Will the recent service sector policy support reverse July’s service sales slowdown?

- Will the recent push to tackle overcapacity draw a line under falling prices and falling price expectations?