TSF grows at fastest pace in over a year in April

Credit growth picked up in April, led by an increase in government bond issuance.

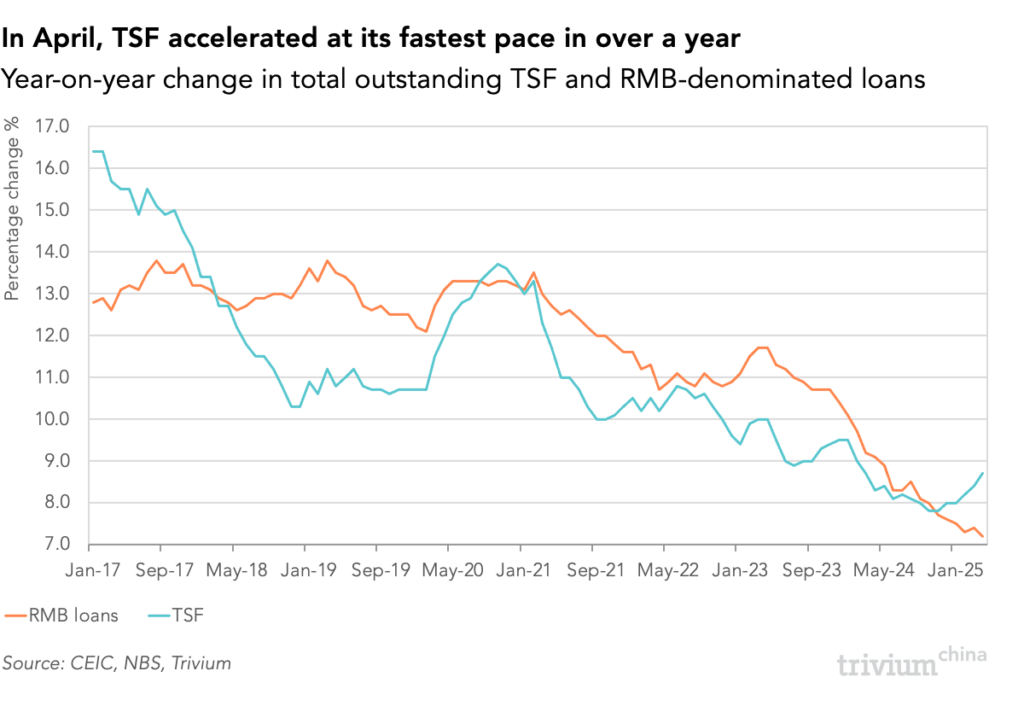

Per data released by the central bank (PBoC) on Wednesday, outstanding total social financing (TSF) grew 8.7% y/y last month, up from 8.4% in March, and marking the fastest pace of growth in over a year.

- Meanwhile, outstanding RMB loans grew 7.2% y/y, down from 7.4% in March – and representing the slowest growth since 1998, when the data series began.

The biggest increase in borrowing was – once again – government bond issuance.

- Net new issuance came in at RMB 972.9 billion, a massive jump from April last year, when issuance contracted.

ICYDK: April is typically a bad month for loans. Banks tend to frontload lending in Q1, after which the pace typically drops off.

- Issuance of household loans and medium- and long-term corporate loans all contracted this April, in line with the trend.

Get smart: In part, corporate borrowing is so weak – and government borrowing so strong – because local governments are issuing bonds to refinance loans borrowed by local government financing vehicles (LGFVs).

Get smarter: While central to Beijing’s efforts to reduce hidden debt risk, this practice obscures whether firms’ overall demand for credit is rising or falling.

Our take: As long as local governments refinance hidden debts with bonds, the usefulness of China’s monthly loan data in drawing conclusions about the economy will remain diminished.