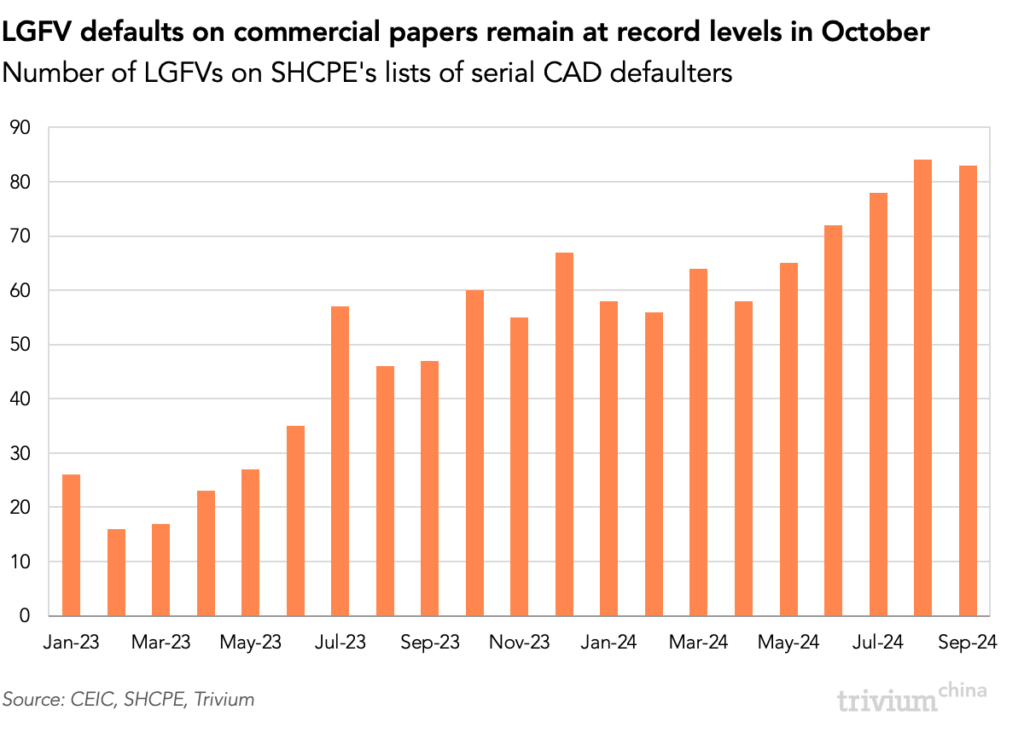

LGFV defaults on commercial papers still at record highs

Local government debt woes showed no sign of improvement in September, according to the latest data on commercial acceptance draft (CAD) defaults.

At the end of September, the number of local government financing vehicles (LGFVs) with repeated defaults on Commercial Acceptance Drafts (CADs) had dropped slightly to 83, down from the record high of 84 in August.

Refresher: CADs are tradable, non-interest-bearing IOUs with a fixed maturity (see our October 20 note for more details on the instruments).

- LGFVs issue CADs to pay suppliers and contractors in lieu of cash.

- The Shanghai Commercial Paper Exchange, a unit of the central bank (PBoC), publishes monthly lists of CAD defaulters – LGFVs with unsettled debts and more than three overdue payments in the previous six months.

Why we care about CADs: LGFVs are more likely to default on CADs than bonds, as bond defaults can trigger creditor negotiations and debt restructuring.

- This makes CAD defaults an early warning sign of financial distress.

Get smart: As tax revenues decline and land sales plummet, local governments are bleeding revenue.

- Without the necessary funds to remain solvent, LGFVs are forced to delay payments to private suppliers and contractors.

Get smarter: Beijing’s upcoming fiscal package will provide much-needed aid to local governments, but addressing the long-term local debt challenges will necessitate a more fundamental realignment of tax revenue distribution and spending responsibilities.