China’s deflation worsens in September

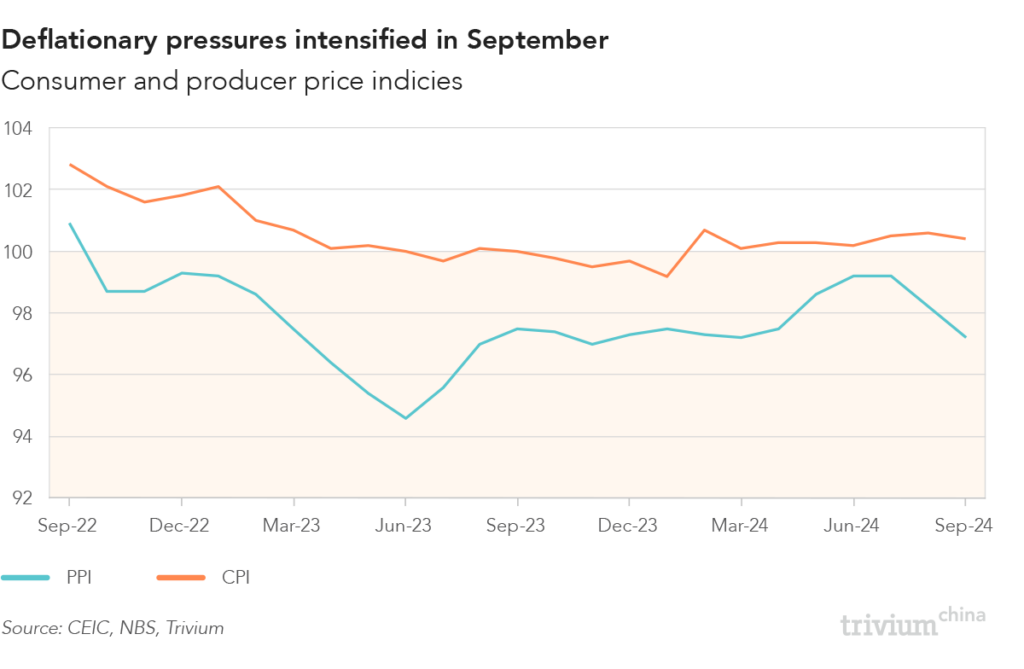

Deflationary pressures intensified in September.

Per data released by the stats bureau (NBS) on Monday:

- Consumer prices (CPI) grew 0.4% y/y in September, down from 0.6% growth the previous month

- Producer prices (PPI) fell by 2.8% y/y, an acceleration from August’s 1.8% decline

CPI growth was driven by food prices, which grew by 3.3% y/y, the fastest growth in 17 months.

Core CPI – which strips out food and energy prices – grew by a paltry 0.1% y/y.

- On a month-to-month basis, core CPI fell by 0.1%.

- This is the fifth time since March that core CPI has fallen on a m/m basis.

Producer prices have now fallen for 24 consecutive months.

- September’s decline was the fastest in six months.

Get smart: The cyclical pickup in food prices is supporting headline CPI growth, but far more critical is the persistent slowdown in core CPI, which indicates China is dangerously close to slipping into consumer price deflation.

Get smarter: The sharp contraction in the PPI this month is also highly concerning, as it underscores the deep weakness in domestic demand.

- This industrial deflation is forcing up real interest rates for companies and increasing the real cost of debt, thereby undercutting the impact of the central bank’s recent monetary relief package.