Cutting rates is getting harder

It’s getting harder to cut interest rates.

On Thursday, Zou Lan, director of the central bank's (PBoC) monetary policy department, told a press conference:

- “There are certain constraints on the further decline of deposit and loan interest rates.”

Zou cited banks’ net interest margins (NIMs) as a constraint on lower lending rates.

- At end-June, bank NIMs were 1.54%, a record low.

Meanwhile, the scope to cut deposit rates is limited by:

- “The speed at which deposits are being diverted into asset management products”

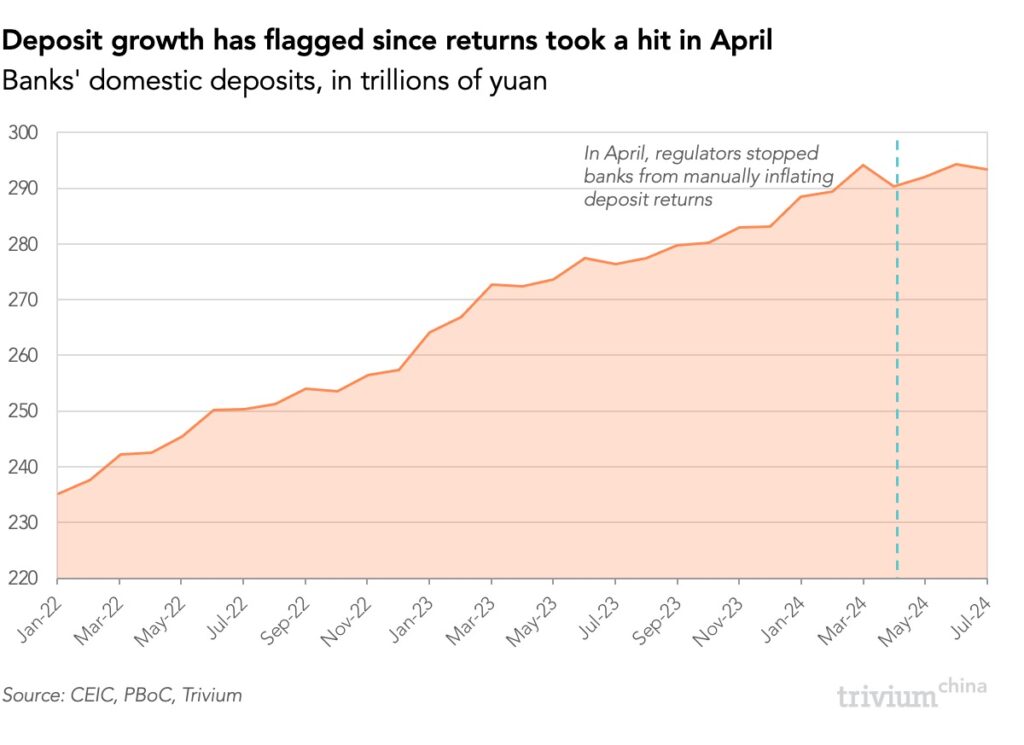

Some context: Returns savers can earn on their deposits have fallen significantly.

- In July, major banks kicked off a round of deposit rate cuts – the first since December – that saw interest rates on one-year deposits decline about 10 bps and those on deposits longer than two-years fall 20 bps.

- In April, authorities cracked down on banks manually adjusting rates to give large depositors returns exceeding the permitted upper limit.

Get smart: Banks have struggled to increase deposits as savers put their funds into wealth management products and other assets with higher returns.

- Banks can raise capital through other means, such as issuing bonds. But no other funding source is as cheap – or stable – as deposits.

- Hence, cutting deposit rates too much could undermine bank stability.

Our take: Interest rates will fall further, but the pace of decline will remain very slow.